Intuition

Women and men are susceptible to different types of illnesses – so it makes sense to have a policy that’s designed especially for you. Intuition covers you against major serious female-related health conditions, helping with medical costs and making sure you have an income if you’re unable to work. This could be a real comfort if you also have dependants and need to make provision for them.

No one likes to think about a serious illness affecting them, but it makes sense to know the odds and to protect yourself against them.

- 1 in 8 women will be diagnosed with breast cancer

- Women are 3 times more likely to develop rheumatoid arthritis than men

- 1 in every 100 pregnancies is ectopic

- Women are 8 times more likely to develop lupus than men, usually between the ages of 18 to 45

- The minimum cost of cancer care in the GCC is around $15,000

Intuition gives you the reassurance that you and your children will be looked after if the worst happens and gives you a financial cushion to cover the costs while you concentrate on getting well.

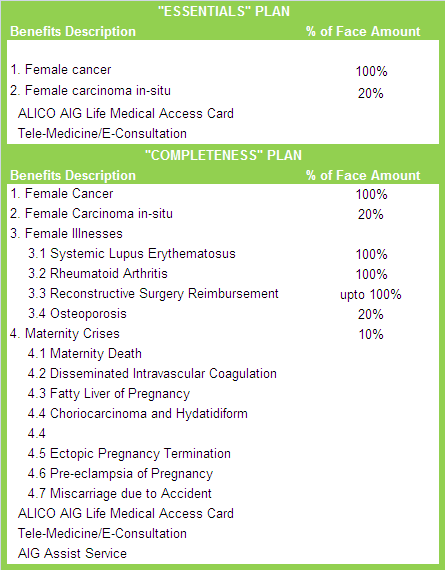

- Intuition is the only Critical Care protection in the GCC designed to protect women against female related conditions such as female cancers, female related diseases, maternity complications or osteoporosis from an early stage of diagnosis.

- Up to $100,000 lump sum paid immediately if you are diagnosed with any covered female illness

- Free access to expert medical advice through World Care International. This offers a free second opinion or case management consultation from world renowned medical centres in the USA specialising in the treatment of serious conditions

- Includes Alico Medical Access Card which gives you discounts from 10% to 30% off medical and dental treatment at selected medical providers in UAE, Bahrain, Qatar and Oman

- Intuition provides an invaluable top-up to all other medical plans you have and covers expenses not normally met such as loss of income for your spouse or care giver, housekeeping and childcare costs, costs relating to non-covered “experimental” treatments and lost income when you survive a critical illness

Get a Quote

Eligibility

Minimum age 18, maximum age 59. Renewable up to age 65, subject to conditions.

Currency

US Dollar

Minimum and Maximum Amounts

The minimum sum that can be assured is $15,000, the maximum is $100,000. The minimum premium is $200. Both the minimum face amount and the minimum premium must be met.

Premium Modes

Annual, Semi-Annual, Quarterly or Monthly

Gender

Female

Subject to policy terms and conditions

/230x176_c057.jpg)

Support during unexpected illnesses

Collection of Personal Data