Say yes to protecting your everyday, with accident and hospitalisation cover

EverydayProtect provides confidence to live and work freely - with financial support if you become injured or seriously ill.

When you have simple and affordable protection cover from MetLife, you can feel confident to live the life you love should life throw you off track through accident or illness.

We will help you keep going, allowing you to pay your way, do your bit and take care of your family, career and lifestyle.

Why EverydayProtect?

Security for the unexpected

EverydayProtect is a quick, simple solution to make sure you get the extra financial support you need if you’re injured in an accident or need to spend time in a UK hospital.

24/7 coverage

Five levels of cover

Access to a virtual GP

24/7 unlimited access to GP appointments, 365 days a year, plus second medical opinions, consultations and more to help you live and work with confidence.

Wellbeing support

You will also have free and unlimited access to our Wellbeing Support Centre, provided by Health Assured. It offers a wealth of expert resources helping you to live happily and healthily.

How does EverydayProtect work?

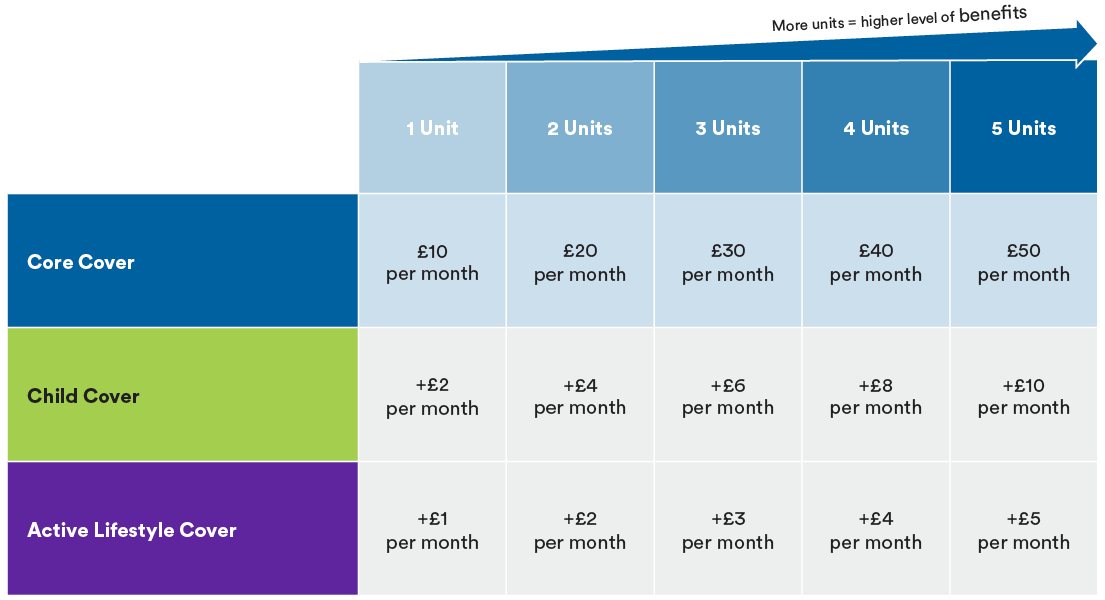

EverydayProtect starts with Core Cover. This automatically includes the following benefits, with a monthly premium from £10 up to £50.

What does it cover?

Broken bones

Broken bones cover is up to £5,000 per broken bone, even if you break more than one.

Accidental death

Accidental death should the worst happen, EverydayProtect provides cover for up to £100,000.

Total permanent disability

Total permanent disability - unable to look after yourself ever again - cover up to £250,000.

Accidental permanent injuries

Accidental permanent injuries covers a wide range of life-changing injuries up to £125,000.

UK hospital stays

UK hospital stays cover is up to £250 per 24-hour period you're admitted to hospital due to an accident or sickness (sickness is covered once you have held your policy for at least 12 months).

Non-accidental death

Non-accidental death up to £10,000 if you die as a result of natural causes, or your premiums returned if your death is within the first year of your policy starting.

Make cover work for you

Optional Child Cover

Protect your children as well as yourself, giving you peace of mind should the worst happen, from £2 per month.

It covers all your children resident in the UK, whether they are living with your or not.

Optional Active Lifestyle Cover

Provides cover if you suffer a serious dislocation, ligament tear or tendon rupture. Add Active Lifestyle Cover as part of an EverydayProtect policy, from just £1 per month.

Choose your level of protection

MetLife EverydayProtect is an affordable protection plan that can be tailored to suit your needs.

There are 5 levels of cover, choose between 1 and 5 units – the more units you buy the higher your benefits will be and your monthly premium will be higher too.

Useful resources and downloads

Contact us

Our experienced team are ready to take your call, whether you want to talk about your policy, update your details or speak to an account manager. We’re here to help.