Mortgage repayment cover that offers more

Get peace of mind with an affordable mortgage protection policy.

Our mortgage protection policy ensures your mortgage repayments are covered if you can't work due to an accident or illness. With MortgageSafe, you can rest easy knowing your home is protected even during tough times.

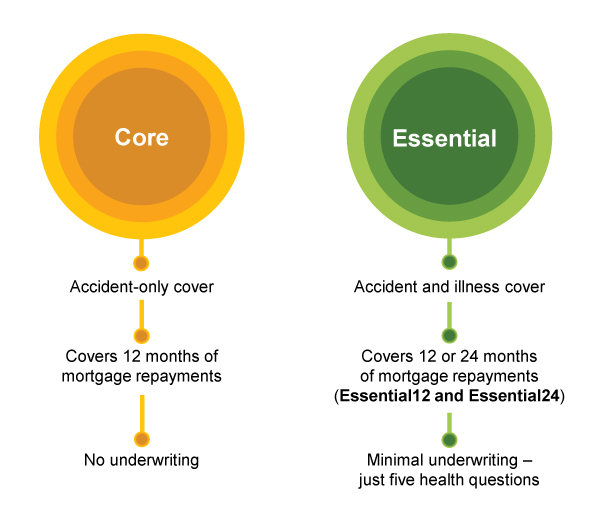

Three levels of cover

Core cover

Accident-only cover that provides 12 months of mortgage repayment with no underwriting

Essential12

Accident and illness cover that provides 12 months of mortgage repayments with minimal underwriting (just 5 health questions).

Essential24

Accident and illness cover that provides 24 months of mortgage repayments with minimal underwriting (just 5 health questions).

Our mortgage repayment protection insurance offers three types of cover to suit different needs and budgets

Watch this video to understand the underwriting journey for Essential12 application.

Watch this video to understand the underwriting journey for Essential24 application.

Why MortgageSafe?

Application is simple

Simple and affordable

Optional child cover

Discover mortgage repayment cover that offers more

Whether you’re a first-time buyer or are returning to the property market,

everyone should be able to protect their home. But it’s not just an affordable

policy that you need – it’s also about giving you the cover you deserve.

That’s where MortgageSafe comes in.

Core vs Essential Protection

Your MortgageSafe cover

MortgageSafe is designed to give you the confidence and security you need to protect your home. Our policies are flexible, affordable, and tailored to meet your needs.

- A four week wait period. There's a four week wait between your initial claim and your first payout, so you won't have to worry about long delays before receiving the financial support you need.

- Unlimited claims. You can make as many claims as necessary, ensuring that you are always protected, no matter how many times you face unexpected challenges.

- Up to 110% of the value of your monthly repayments. We cover up to 110% of your monthly mortgage repayments, up to a maximum of £1,500, giving you extra financial support to manage additional expenses that may arise.

- Backdated to day 1. Your coverage is backdated to the first day of your claim, so you’re covered right from the start.

- Won’t impact Universal Credit. Payouts from our MortgageSafe cover won't affect your eligibility for Universal Credit, so you can receive the support you need without any extra worries.

- No compulsory GP reports. We won’t check your eligibility based on compulsory GP reports, accident reports, or seek any other type of medical evidence.

Useful resources and downloads

Want to make a claim?

Our Claims Team are here to support you and your family when you really need it.

FAQs

Whether you’re a first-time buyer or are returning to the property market, everyone should be able to protect their home.

With MortgageSafe, you can be confident your mortgage repayments are protected if you have an accident or are ill and can’t work, so aren’t earning your usual income as a result.

MortgageSafe safeguards your home against unpredictable life events. From the first day you're unable to work due to illness or injury, MortgageSafe steps in to make your monthly repayments.

Plus, with minimal underwriting, you can get coverage of up to £1,500 per month for up to two years. It's all about providing you with the financial security you need when life throws you a curveball.

MortgageSafe is only available through a financial adviser. To find an adviser who can talk you through the options available to you, try Unbiased.

If you'd like to speak to one of our customer services team, you can call us 0800 917 0100. If you’d like to email us, please do so on customerservice@metlife.uk.com.

It’s easy to apply for our MortgageSafe mortgage protection insurance. You’ll need to be over 18 years of age, a UK resident, and need to either work a minimum of 16 hours per week in permanent employment, have been self-employed for 6 months continually, or be on a fixed-term contract for at least 24 months before the first date of the policy.

You also need to have at least five years outstanding on your mortgage at the start of the policy.

Our Claims Team is here to support customers and their families when they really need it. To make a claim on MortgageSafe, head to our claims page.

Contact us

We're here to help