Summary

- Group Income Protection claims can be more complicated than other Group products. Here are the factors we build in when assessing GIP claims.

The nature of group income protection (GIP) can make its claims seem more complicated than other group risk products. However, a robust process and good working relationships can remove these complexities and deliver significant benefits for all parties.

Absence notification

On an eligible GIP claim, benefits become payable once an employee has been unable to work for a set period of time, known as the deferred period. This deferred or waiting period is selected by the employer and is typically 26 or 28 weeks, although insurers offer a range of options from 13 weeks to 104 weeks. See ‘What is a group income protection policy’ for more details on GIP policy design.

Although benefits do not become payable until the end of the deferred period, employers should inform their GIP insurer of any absence that could potentially be a claim, long before that point.

MetLife recommends that employers notify their claims assessor of any absence where an employee has been unable to work for two to four weeks. This has benefits for the employer, the employee and the insurer.

Early intervention

Where an employer notifies an insurer of an absence before the end of the deferred period, the claims assessor can determine whether it would be beneficial to involve the early intervention service.

This works with employees to understand why they are absent from work, how their illness or injury is affecting them and the steps that can be taken to help them recover and return to work as quickly, safely, and sustainably as possible.

At MetLife, we work with a specialist partner, HCB Group, to provide our early intervention service. Its team of case managers are skilled at understanding how to support employees who are unable to work.

Treatment and rehabilitation

Exactly what support is required depends on the individual needs of the employee but it could include access to treatment and rehabilitation to speed up a recovery; counselling; and/or changes in the role or the workplace to enable the employee to return to work.

As an example, where a course of physiotherapy would help an employee return to work but there is a six-month waiting list on the NHS, an insurer may look to fund it to enable a faster recovery.

The early intervention service will also liaise with the employer to recommend any reasonable adjustments or support that could be implemented to help the employee return to work.

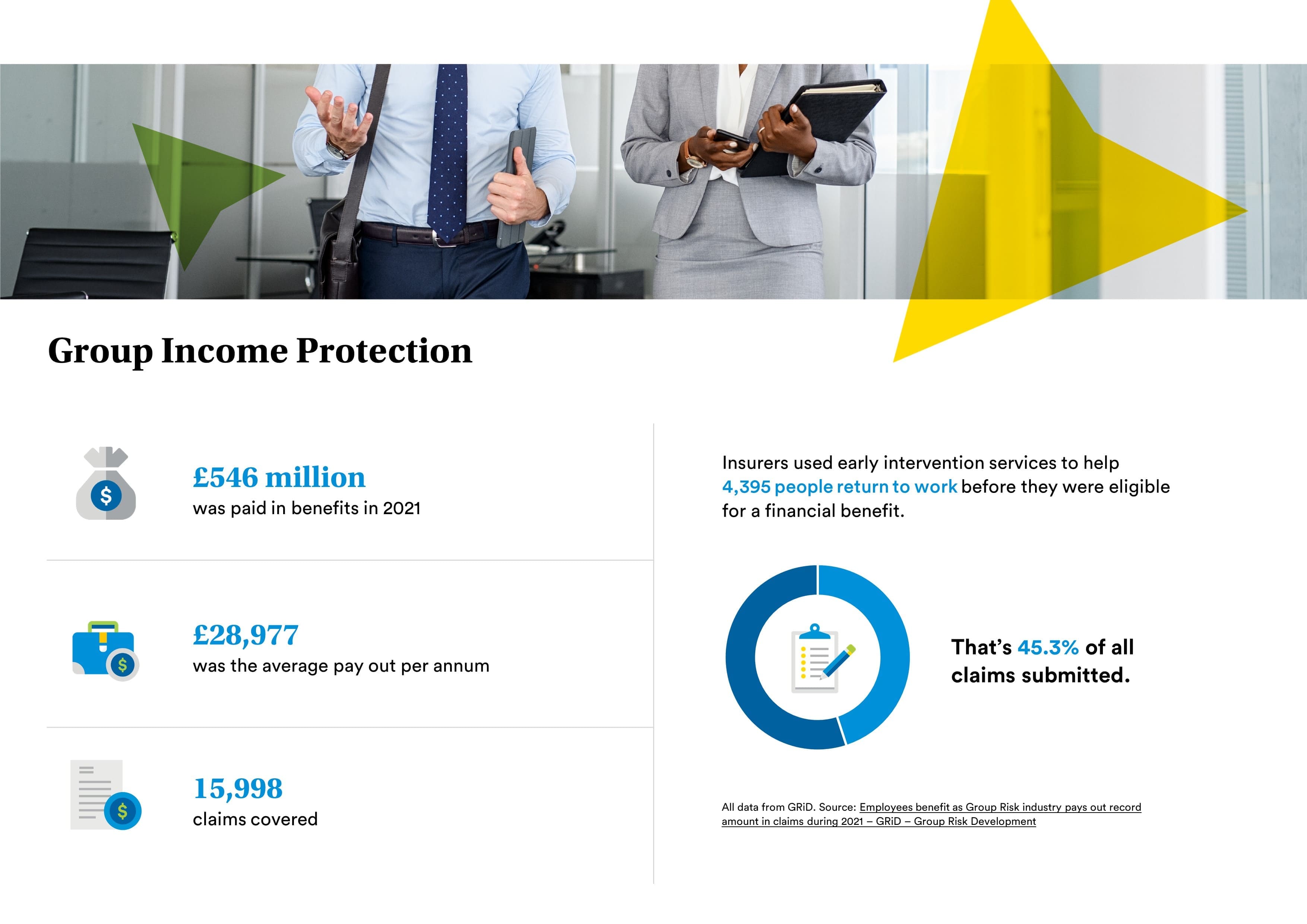

Return to work results

This approach works. Claims data shows that the earlier an employee receives help and support during their absence, the greater their chances of returning to the workplace. For example, based on data from MetLife, 94% of employees returned to work when it was notified of their absence within the first four weeks.

It can even prevent an employee becoming a claim altogether. According to our data, this is the case for around two-thirds of cases that are supported by the early intervention service.

More information on the benefits of early intervention can be found in our guide to minimising employee absence.

Fast claim assessment and payment

Early notification of a potential claim also enables an insurer to start assessing a claim before benefits become payable at the end of the deferred period.

Although the early intervention service can help many employees return to work before the end of the deferred period, this is not always the case. The nature of some illnesses or injuries will mean it is inevitable that they will become a claim.

But, by using the deferred period to gather information and evidence to support the claim, the insurer should be able to speed up the claims assessment process.

This benefits all parties. Employers usually align the deferred period with their sick pay arrangements, so a timely GIP payment is beneficial for them and their employees.

Flexible claims solutions

As every claim is different, insurers offer plenty of flexibility around their claims solutions to ensure they can best support both employees and their employers.

Where an employee can return to work on a part-time basis or in a different, lower-paid role, an insurer can adjust their benefit level to support them. For example, if someone is on 50% of their normal pay, an insurer would pay 50% of their benefit to reflect the earnings they had lost. This makes it easier for the individual and their employer to facilitate a gradual or phased return to work.

There may also be situations where someone is better suited to a different role with another company. In these situations, a one-off lump sum payment could be an option, enabling the employee to fund training and launch a new career, for example.

Certainty around absence

Another key benefit of the GIP claims assessment process is that it gives the employer certainty about absence.

It can be difficult for employers to know how an employee’s illness or injury will affect their ability to work, which can limit any business planning. The expertise provided through an early intervention service enables an insurer to provide detailed insight into the employee’s situation and how it might affect their return to work.

This allows the employer to plan around the situation while also ensuring the employee’s needs are fully understood so they can focus on their recovery.

Dedicated claims assessors

A good relationship between the insurer, the employee and the employer is key to a smooth and beneficial claims process.

At MetLife, we aim to give all our clients and brokers a dedicated claims assessor who will look after any claims on their scheme. This helps to build a good working relationship between the two parties and a greater understanding of what the employer does, how it manages absence and what its needs are when someone is absent from work.

Having this single contact is also beneficial for the employee who is absent from work. The claims assessor will have a good understanding of their circumstances and be able to liaise with the employee, the employer and the early intervention service to ensure the best outcome.

As an example, although an employee may have been off work for a year or more, if there is a change in their condition, their claims assessor can refer them to the early intervention service for any rehabilitation that might help them with their return to work.

Working together in this way helps to make the claims process smooth, delivering the support and results that benefit employers and their employees.

Although the risk of a member making a claim increases with age, the size of the potential claims payment also reduces with age. As a result, rates start to fall as a member’s age approaches state pension age and the potential claim size is limited.

Female rates also tend to be slightly higher than male rates on group income protection. This is because they are more likely to suffer an illness or injury that prevents them from working long-term.

Calculating an organisation’s base rate

To calculate the base rate for an organisation, an insurer would take the rate for each member and multiply it by the benefit level they have, to get their base rates.

Every member’s base rate is then added up to achieve a rate for the policy. Therefore, although a single rate will be attributed to the organisation, it will reflect the risk presented by the individual members who will be covered by the policy.