Flexible cover when you need it, with MultiProtect

Flexible, affordable protection for you and your family, at home and abroad.

For complete peace of mind

Flexible cover

You never know what’s around the corner, that’s why it’s important to protect yourself and your family against unforeseen events. MultiProtect provides financial support for a range of specified accidental injuries and hospital stays in the UK and select European countries. You can make claims for multiple injuries, and your policy will keep protecting you in the future.

Cover, whatever the circumstance

Great value

Peace of mind

You can’t put a price on your family’s financial wellbeing. That’s why we offer accidental and non-accidental death cover at home and abroad.

All about MultiProtect

There are many benefits that come with our comprehensive MultiProtect product. Keep reading to learn all the ways MultiProtect can help keep you covered and give you peace of mind in any situation.

Access our wellbeing support centre

There are many benefits that come with our comprehensive MultiProtect product. Keep reading to learn all the ways MultiProtect can help keep you covered and give you peace of mind in any situation.

UK and European hospital cover

You'll get coverage for hospital stays in the UK or select European countries* for every 24 hours you're an in-patient due to an accident. Plus, after you've had your policy for at least 12 months, you can also claim for time spent in the hospital due to sickness.

Optional child cover

From birth until their 23rd birthday, we'll protect your children for as little as £2 per month, including if they are diagnosed with cancer.

Active Lifestyle cover

Active lifestyle cover gives you extra protection if you get injured in an accident resulting in dislocation, tendor rupture, or ligament tear. We'll help you back on track so you can continue enjoying the activities you love.

Choose your level of protection

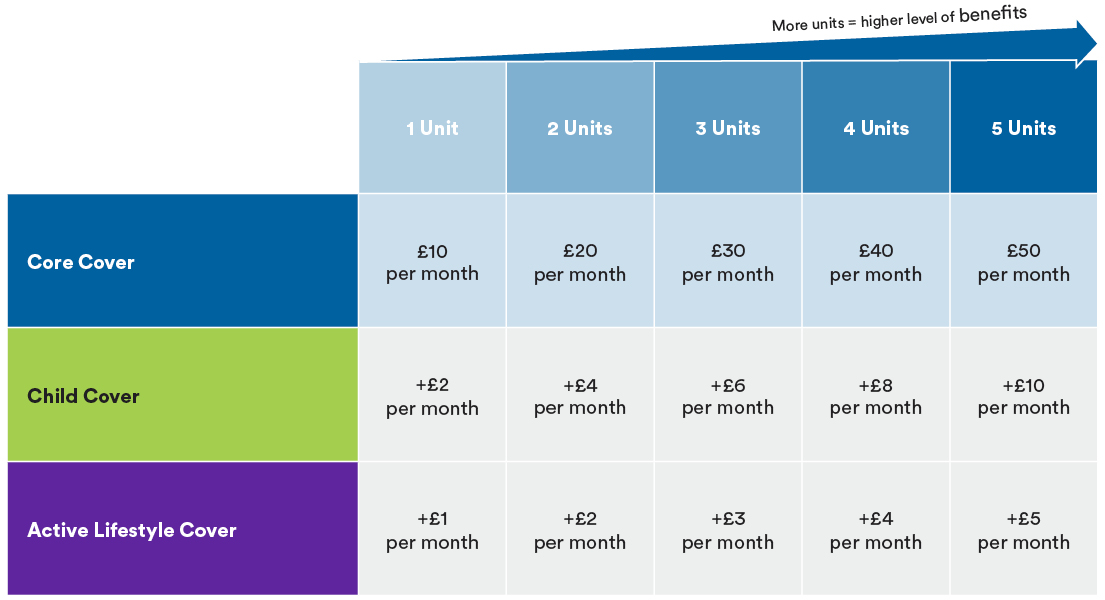

MultiProtect is an affordable protection plan that can be tailored to suit your needs. There are 5 levels of cover, choose between 1 and 5 units – the more units you buy the higher your benefits will be and your monthly premium will be higher too

Useful resources and downloads

FAQs

MultiProtect ensures that you and your family are protected from the financial impact of accidents or hospitalisation due to illness. For example, broken bones, being hospitalised due to illness, and more. Think of it as your financial safety net that protects you against life’s twists and turns.

As a protection product, MultiProtect works to secure not only your financial stability but also your peace of mind. It helps you manage the financial risks associated with health issues and unexpected life events.

Any benefits you receive from the policy are free from UK income tax and capital gains tax. However, inheritance tax may apply to any payments made after the death of a covered person. Keep in mind, the government could change these tax rules. Taxes are based on your personal circumstances and may change over time.

You can make a claim by either calling us on 0800 917 0100 or writing to us at Claims Team, MetLife, PO Box 1411, Sunderland, SR5 9RB. Alternatively, fill out the form below and we’ll call you back ASAP.

Contact us

We're here to help

Additional protection products

MultiProtect is only available from Openwork. To find an Openwork adviser click here