Adding Value

Summary

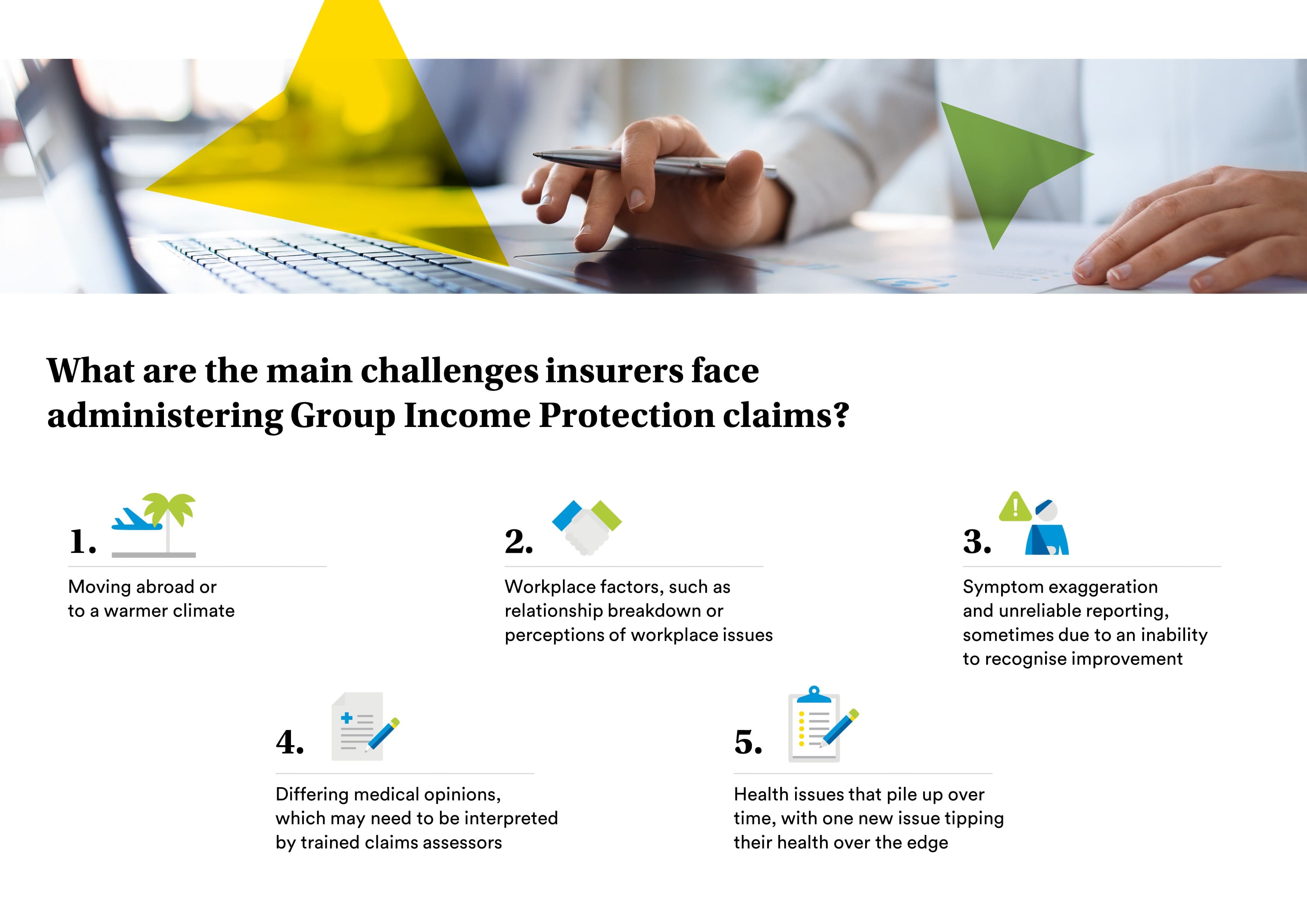

- Here are the main challenges insurers see when administering Group Income Protection claims.

Group income protection (GIP) claims are very rarely a one-stop assessment, with claims assessors regularly speaking to employees, employers and medical professionals to support the claim.

This approach means that, across the industry, more than £546 million was paid in benefits in 2021 according to Group Risk Development (GRiD). In addition, insurers used early intervention services to help 4,395 people return to work before they were eligible for a financial benefit on GIP.

Regular dialogue works well in most claims, enabling the insurer to support the claimant as their needs change. However, there are some claims situations that can be more challenging.

These are the main challenges we come across and how we resolve them.

Differing medical opinions

Medical professionals don’t always agree so there will be some claims where there are different opinions on the employee’s medical condition and their prognosis.

Workplace factors

In some claims, workplace issues such as a poor relationship with a line manager or a heavy workload may arise in our conversations with the employer or, more commonly, the employee. We refer to these as perceptions as they are based on the way one person sees something and we will often see different views being presented across a claim.

While a workplace issue can be a cause or contributing factor in an employee’s absence, it is important that we fully understand the situation. GIP pays benefit where an employee is unable to work long-term as a result of illness or injury, not simply because of a workplace issue, so our claims assessors will seek to determine which are genuine claims.

We’re also aware that a workplace issue can be a barrier to someone returning to work after illness or injury so, where possible, we will look at ways to resolve it as part of managing the claim.

Symptom exaggeration and unreliable reporting

On a long-term claim, the way someone’s illness or injury affects them can change as treatment starts to take effect or recovery begins. However, this isn’t always reported to the insurer.

This issue, which we call ‘symptom exaggeration’ or ‘unreliable reporting’ may be because the employee doesn’t recognise the improvement in their condition or it could be because they are so used to being absent and reporting symptoms.

Where the claims assessor believes the employee’s symptoms aren’t in line with medical information, they will assess the claim to see whether there is any evidence of exaggeration or unreliable reporting. As an example, the employee might say they can’t walk for more than a couple of minutes but then chat about how they’d walked the kids to school.

“I feel so much better in the sun”

Where someone is absent for a long time, they may make more significant adjustments to their life to deal with their illness or injury. In some cases, an employee may even move abroad to take advantage of the fact that a warmer climate alleviates some of their symptoms.

Although the move may legitimately be for health reasons, this can be challenging from a claims perspective. In these situations, the claims assessor will look carefully at why the person is off work to ensure that their absence is still caused by an illness or injury rather than a lifestyle change.

The straw that broke the camel’s back

Health is very subjective, with the types of conditions and the way we experience them varying from person to person. Many claims will be complex with the employee having more than one condition, or something that’s difficult to define, preventing them from working.

Insurers also come across situations where an employee has been working for years with all sorts of health conditions without complaint and then suddenly something worsens or they get something new and they stop working.

Although these are often genuine claims, they can be more challenging than the simpler claims. In these situations, the claims assessor will need to work through what’s happening with the employee to gain a proper understanding of what’s changed to stop them working.

Regular dialogue and detective work

Communication is essential in all claims, whether the most straightforward or something more complex. At MetLife, our claims assessors build a relationship with their claimants, helping to understand how their illness or injury affects them and where support from early intervention and rehabilitation services could facilitate a faster return to work.

The complexity of GIP claims means an element of detective work also comes into play. Claims assessors will often pull together medical information as well as insight from the employee and employer to find the best way to support a claim.

Building a detailed picture of the insight and a good relationship with all parties enables claims assessors to deliver a good experience.