Adding Value

Group Life insurance is a valuable employee benefit, providing an employee’s dependants with the financial reassurance of a tax-free lump sum in the event of their death.

Over the years, value-added services have been added to the product to provide a more compelling offer to insurance customers, helping them address some of challenges they might have with the retention, motivation and recruitment of talent.

Short on time? Get all the information you need, here

This short video explores the how Group Life value-added services help in supporting and attracting key talent.

We know from our recent research that employee benefits are one of the top five non-financial considerations when choosing a place to work. But it does more than attract talent, it can provide strong motivator to stay at a company.

That same research also found that two thirds (65%) of respondents would decline a job offer with a 10% pay rise if their current job provides better employee benefits.

Emotional support provided through Group Life

Emotional support is at the core of Group Life value-added services.

When an employee, or someone in their family passes away, it is an incredibly emotional and overwhelming time for all involved. Support services help provide an immediate and ongoing crutch, a shoulder to cry on, and a helping hand.

Grief is a very personal and potentially overwhelming experience. Bereavement counselling can help someone come to terms with their loss, understand the grieving process and enable them to move on.

Being able to offer an employee’s family these benefits is positive for an employer too, giving the reassurance that they will have access to expert advice and support during this difficult time.

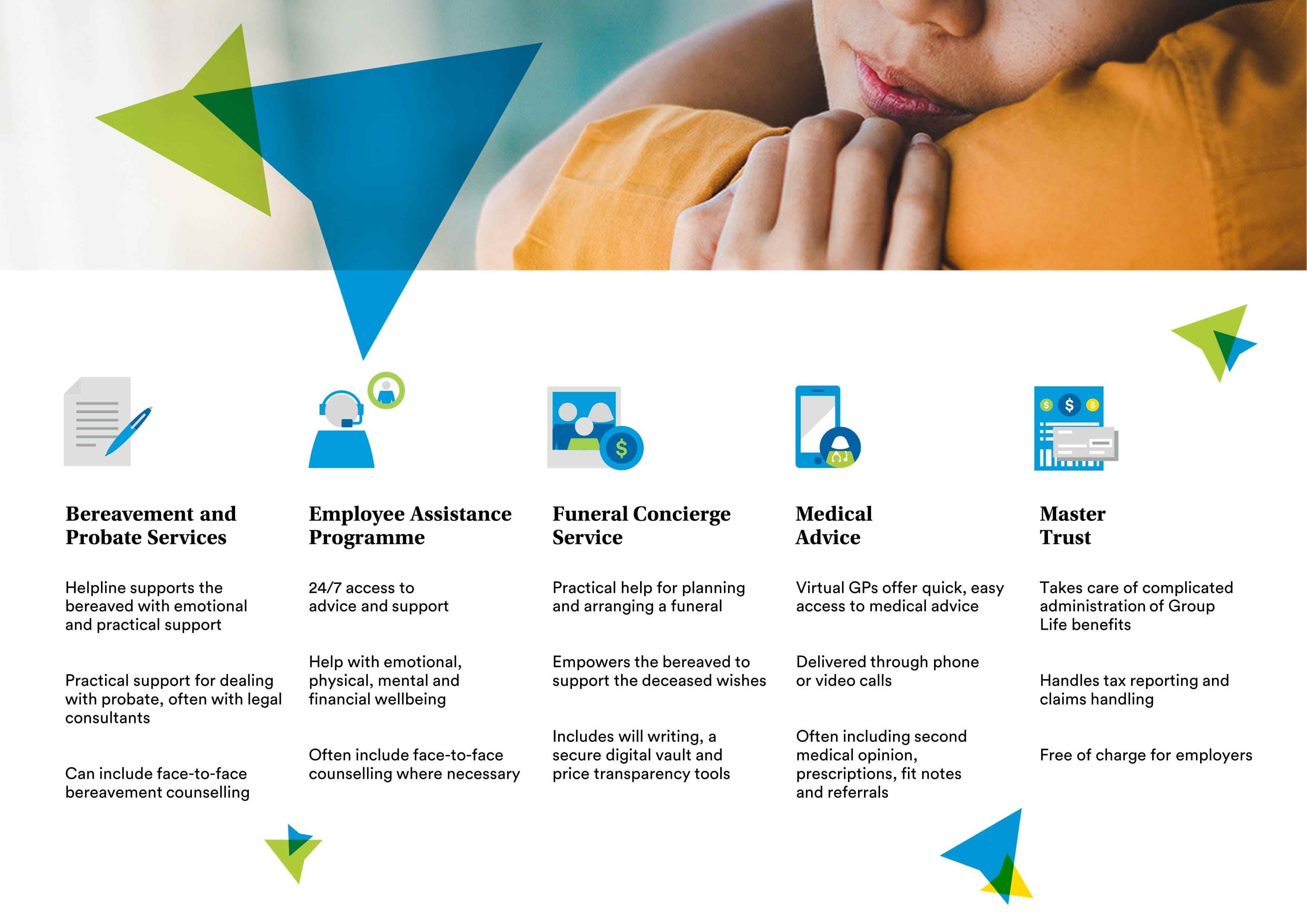

Typical support services for Group Life include:

- A bereavement and probate helpline

- Support to cope with terminal illness

- Face-to-face counselling sessions

- Practical support for dealing with probate, often with legal consultants

Practical help when someone passes

At MetLife, we’ve also introduced a new, unique way of supporting employees and their families when someone passes.

It’s called a funeral concierge service, and with one phone call, the bereaved can access practical support for planning and arranging a funeral, removing stress and giving families more time to grieve.

The adviser empowers to bereaved to make informed decisions related to the funeral and can compare and negotiate best prices at any funeral home in the world.

Accompanying this, are tools to support the wishes of employees, such as an online will writing platform, a secure digital vault to store important information and treasured memories, and other online planning tools.

The services act as to guide for families through a very emotional, complicated and confusing time in their lives.

Health and wellbeing support

Many of the services that are included in Group Life insurance can be used without even needing to make a claim. This means that more employees and their families will value the cover their employer offers.

As an example, employee assistance programmes (EAPs) are a common addition to group life insurance policies. These provide 24/7 access to expert advice and information to support an employee’s emotional, physical, and mental wellbeing.

Calls could be on anything from new parent worries or a child’s temperature to an elderly relative’s care needs or the death of a loved one.

Typical support services for health and wellbeing:

- Employee assistance programmes

- Support for mental, financial and physical wellbeing

- Access to trained counsellors, legal consultants and registered nurses

- Access to apps or online hubs with wellbeing advice and guidance

Medical advice

Another value-added service that really delivers is a virtual GP. These give employees access to a GP by phone or video at a time that suits them.

Being able to do this is really convenient, benefitting employees and employers alike. There’s no need to take time off to visit a GP surgery and, as appointments can be made the same day, an employee won’t have to wait weeks to get the medical advice they need.

Getting this medical opinion quickly is reassuring for employees and their families. If treatment’s needed, catching it early can mean a better outcome, and if nothing’s wrong, they can stop worrying about their health and focus on work and life again.

Typical medical services:

- Virtual GP services

- Private prescriptions, open referrals and fit notes

- Second medical opinion

- Employee access via an app

Utilising Group Life value-added services in a workplace programme

Being able to offer these value-added health and wellbeing services is great for employers too. As well as giving their employees access to additional support, employers should link these services with other internal benefits to create a powerful workplace health and wellbeing programme.

Flagging up the value-added services to employees or using them to complement a themed health awareness week can bring an organisation’s health and wellbeing strategy alive.

Supporting employee health in this way drives engagement too, with benefits for talent attraction and retention.

Support with a claim

Many Group Life insurance products also include services that support an employee’s dependants in the event of a claim. This is through the provision of both practical and emotional support.

On the practical side, having access to experts to guide an employee’s dependants through a claim or explain how to register a death or arrange a funeral can make a huge difference.

Being guided through all these practicalities makes the process less stressful and enables them to get back on their feet more quickly after a loss.

How MetLife supports its customers through value-added services:

Our holistic support helps employees through all of life’s ups and downs. Here are the value-added services that are included on MetLife’s Group Life insurance product:

Employee assistance programme (EAP)

A telephone-based support service that is available 24/7, 365 days of the year. Employees, and their families, can speak to an impartial adviser who will be able to provide support and information on everything from debt worries and depression to teen issues and tonsilitis. Advisers can also refer employees to specialist support from legal advisers, counsellors, registered nurses and midwives. This service is available for Group Life schemes under 1,000 lives.

Virtual GP

A 24-hour service giving employees and their families same day access to a GP by phone or video. Employees can have as many consultations as they need, at a time that suits them and wherever they are in the world. As well as GP consultations, this service covers second medical opinions, open referrals, and local prescription deliveries. This service is available for Group Life schemes under 1,000 lives.

Funeral concierge

A comprehensive end-of life planning and support service providing employees support with will writing; a secure digital data vault to store personal information; and online funeral planning tools. At its core is a funeral concierge service, giving families access to expert advisers to support them throughout the funeral process. This includes a price finder tool to give greater transparency around costs.

Bereavement and probate support

A 24-hour helpline providing practical and emotional support to employees and their families. Employees are also eligible for six face-to-face bereavement counselling sessions if required. The support also includes an employer’s guide to bereavement to help them support employees.

Claims management

Empathetic, expert claims handlers are on hand to guide an employee’s dependants through the claims process and support them during a difficult time. We are proud of the support they provide – and the fact that we pay 99% of group life claims within three days1.

Master trust

A value-added service for employers, our Master Trust takes care of all the complicated administration involved in running a trust for group life benefits. Available free of charge for employers taking out a registered group life policy, we look after all the tax reporting and claims handling, leaving employers and their employees to enjoy the tax benefits.

1. MetLife internal data, 2023