Group Income Protection that drives engagement with wellness and early intervention to help keep work working

Affordable policies, engaging employee experiences and proven absent management, that help protect people and productivity.

Prevention and protection

We’re joining forces with YuLife to bring gamified prevention and holistic protection together, giving your clients the help they need to address long-term illness and keep work working.

The UK has a long-term sickness problem, and it’s not getting better. Nearly 3 million people are out of work with ill-health, and it’s holding businesses and their people back.

We've joined forces with leading insurtech provider YuLife to deliver Group Income Protection as it should be, with engaging health prevention and gold standard early intervention - providing much more than just a financial safety net for long-term sickness.

There's never been a more compelling time for preventative benefits.

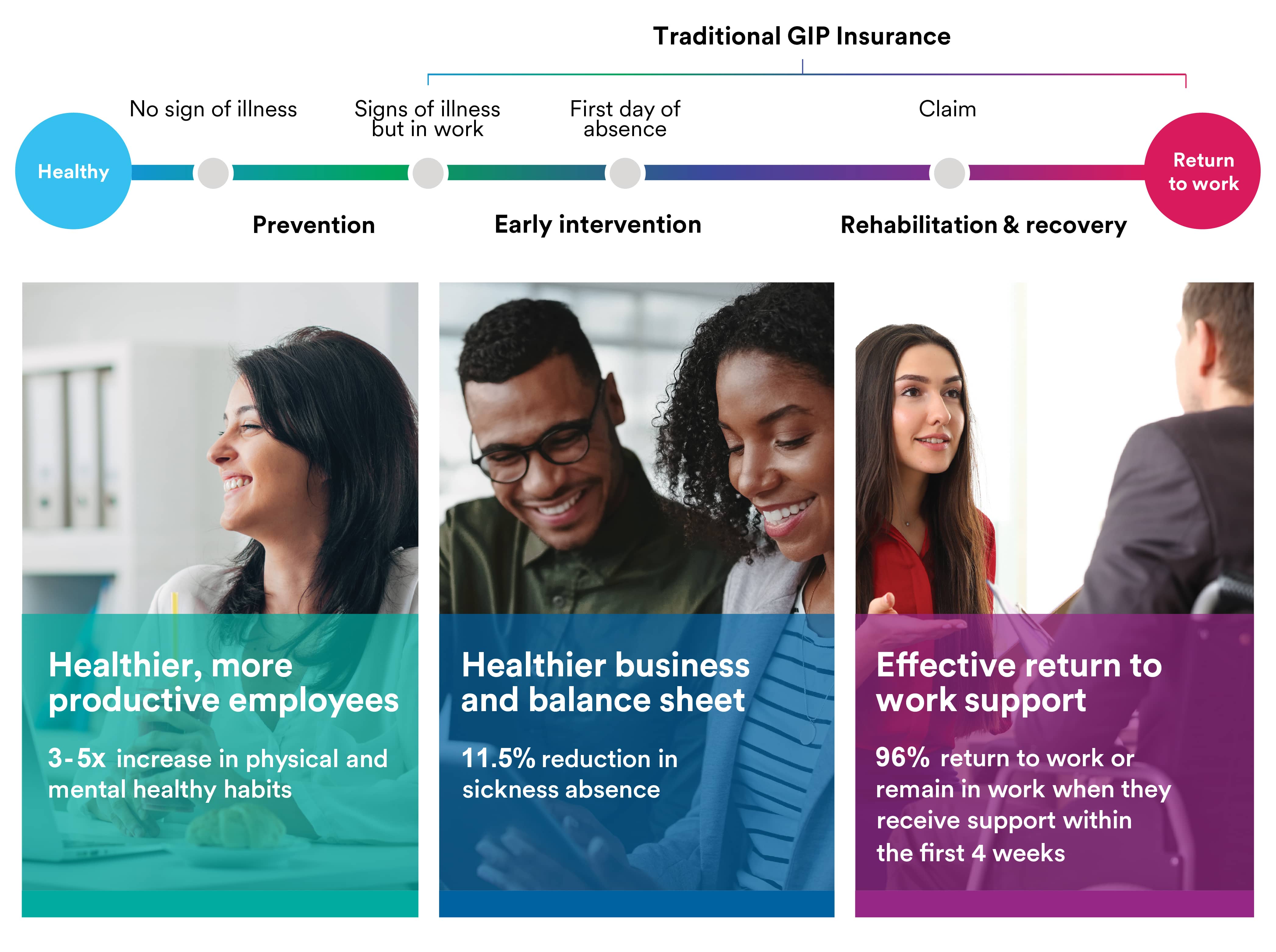

Combining forces to deliver a new insurance model

Group Income Protection that proactively drives engagement with prevention and early intervention, putting employee wellbeing at the heart of the policy, and providing support for the recovery and safe return of those on sick leave.

Benefits of Group Income Protection

Less sick leave, fewer claims

We help keep working people working, as well as supporting the recovery and safe return to work of those on sick leave.

Better absence management

Support employers, line managers and colleagues to better manage impact of illness through reporting and data insights.

A healthier business and balance sheet

Combining game mechanics that drive healthy habits, with a choice of lower-cost Limited Term payment periods.

How it all comes together

Our Group Income Protection supports employees through health and sickness, with gamified wellbeing tools, as well as early intervention, rehabilitation, recovery and return-to-work support.

Here’s what your clients will get:

- Award-winning gamified employee experience

- Access to YuLife’s reward programme app to drive positive mental and physical health habits;

- One access point for all value-added services

- Fast access to GP appointments and counselling where clinically appropriate.

- Gold standard early intervention that can reach out to and support at-risk or absent employees

- Vocational rehabilitation and recovery services to help employees return to work safely

- Clinical pathways that support mental health, musculoskeletal disorders and long-COVID

- Supercharged HR capabilities and insights

- Partial replacement salary to support employees financially when on long-term absence

Driving employee engagement with YuLife

YuLife’s innovative technology makes healthy living fun with rewards for walking, cycling and mindfulness, and incentivises participation with friendly competition and gamification.

Unlike other wellbeing apps, employees love YuLife’s gamified experience - which has an average engagement rate of 93%*. And you can read what people love about the experience here.

*YuLife user survey, 2022

The benefits of a proactive and preventative approach

Through effective early intervention, we aim to reduce the need for claims, ensuring renewal premium is as low as possible.

Lower premium costs

Employees typically stay in a job for 4 years so why pay to insure them for 40?

With Limited Term policies, premium costs are on average 50% lower.

- - Limited term pays out up to a fixed time period

- - Limited term premiums are an average of 50% lower

- - SPA policies pay out until an employee reaches retirement age

- - In fact, the cost of a 2 year payment term is just 20% of the cost of a typical SPA policy

- - And thanks to a focus on prevention and early intervention, which can help people remain in work, our GIP can help ensure that premiums stay low

Want to learn more?

Find all the documents and resources your clients need to get the most from Group Income Protection.

Supporting employers

Everything you need to get a quote and arrange cover for your Group Income Protection clients.

To request a quotation for a Group Income Protection policy, please email ebnewbusiness@metlife.uk.com and include the details requested below.

To get a Group Income Protection quote from us, we will need the following information:

- Company name

- Location

- Nature of business

- Overseas travel

- Claims and medical underwriting information/history (past 5 years)

- Details of any members who have been off sick for more than 90 days within the last 12 months

- Policy design, which should include the following

- Basic benefit and any offsets

- National Insurance and/ pension contributions (if applicable)

- Salary definition

- Eligibility

- Escalation to benefit (if applicable)

- Deferred period

- Payment period

- Termination age

- Membership data, which should include the following:

- Employee names/identifiers

- Category identifiers (where there is more than 1 category)

- Dates of birth

- Gender

- Occupation

- Workplace postcode

- Salary

If your client would like to accept a quote, follow the steps below to arrange cover.

Confirm the quote you are accepting and send this over to our in-house sales team via email at ebnewbusiness@metlife.uk.com, who will be able to place the policy on risk subject to the caveats being answered on the quotation.

Please provide the following if known:

- Start date

- Payment method (Cheque, Standing Order, Direct Debit etc)?

- Payment frequency (annual, monthly etc)?

- Will the payment be made by the insured company?

- Annual review Date?

- Confirmation that the assumptions are correct?

Once we have the above confirmed we can then proceed with placing the policy on risk. Please note, in order to place a policy on risk, we will require all caveats to be confirmed in writing, (email is acceptable) by 3pm the day prior to inception.

At this stage you will be sent the proposal form by your Account Manager or a member of the sales support team.

The completed proposal form can follow within 30 days of the policy’s inception date.

Once you have confirmed the quotation that your client would like to go on risk with, our sales team will process the request and confirm when the policy is active. The invoice and accounts will follow in due course.

If any members need medical underwriting we will let you know so that a Health Questionnaire can be completed.

- The employer should complete the initial policy details.

- The member should complete questions about their lifestyle and medical history.

Download our Health Questionnaire form